Discover how digital transformation is revolutionizing the Quote-to-Cash process, streamlining sales and payments for faster transactions, enhanced accuracy, and increased revenue growth.

In a marketplace dominated by large corporations, small and medium enterprises (SMEs) are facing a constant battle for survival and recognition. Their struggles are multifaceted from sourcing new business to executing them profitably given the global competition. The core of their challenge lies in visibility and connectivity. Despite their crucial role— they contribute up to about 45% of total employment and 33% of GDP in developing countries, as noted by the World Bank. SMEs find it difficult to bridge the gap between offering innovative products and services and connecting with the right customers.

The hurdles they face are numerous: limited marketing resources, constrained budgets, and a lack of widespread networks often leaving them struggling on various fronts from a sustenance angle. The essence of the problem is not just about sustenance; it's about growth, scalability, and the ability to thrive withing the competitive landscape.

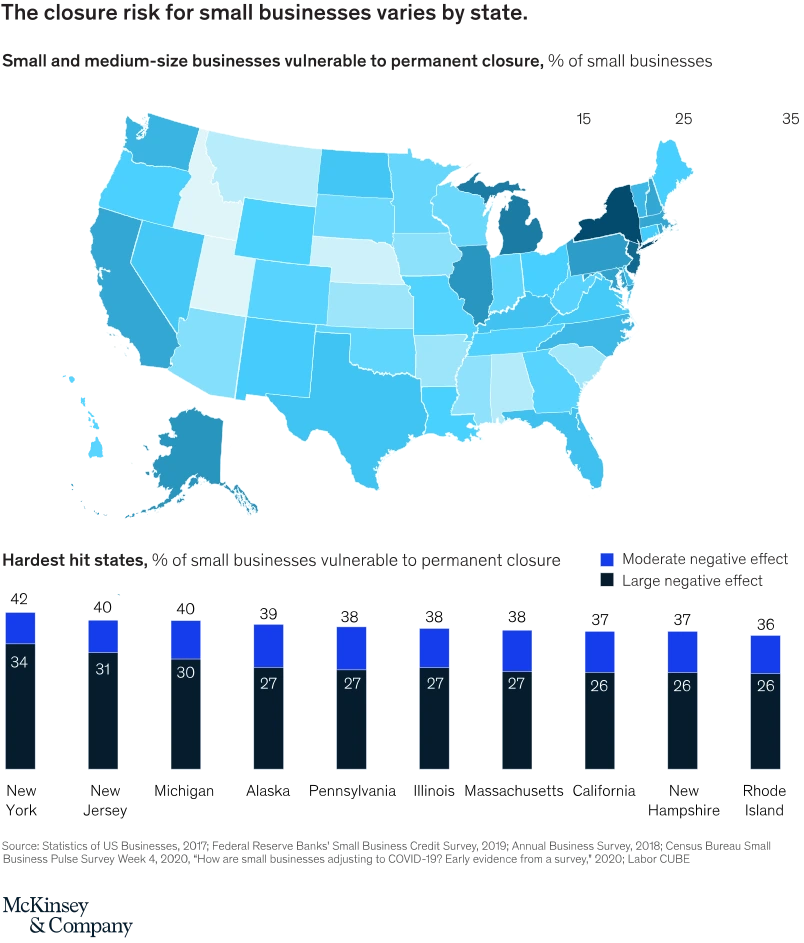

Source: Pandemic impact on Small Businesses- McKinsey&Company

Digital Transformation Imperative for SMEs

The industrial landscape has completely changed post COVID especially for small and medium enterprises (SMEs). The pandemic brought about significant changes for which the SMEs had to adapt quickly to the vulnerabilities in the global supply chains. A report by McKinsey & Company highlighted how the Pandemic accelerated digital transformation by several years, with companies shifting towards digital interactions at an unprecedented pace. This shift has been particularly impactful in the SME segment, pushing them to quickly adapt to the challenges in maintaining their market presence and business continuity.

There has been a notable shift toward digital platforms, offering SMEs new avenues to connect with customers and suppliers thanks to these disruptions and the acceleration in the digital transformation initiatives. Reports by the World Economic Forum highlights, digital platforms can enhance visibility, improve access to markets, and foster better integration with global supply chains, which is crucial for SMEs aiming to navigate the post-pandemic landscape effectively.

What SMEs desperately need is not just a solution but something revolutionary – a platform that not only understands their challenges but also offers guidance and handholding to overcome them. A platform that can bridge the gap between them and the potential customers seeking their services and products.

This is where the concept of 'Quote to Cash' comes into play. It's not just a process; it's a lifeline for SMEs, encapsulating the essence of their journey from potential leads to profitable business. But how can this be achieved?

Enter Cnerzy, a startup that's not just another platform, it is about empowering SMEs and envisions to place them right in front of their target audience.

How does Cnerzy achieve this task?

- Onboarding: The first step in Cnerzy's journey with SME is onboarding, a process that's not just about listing a business but understanding its core, offerings and potential. This nuanced approach ensures that when we promote an SME, we are showcasing their strengths, their uniqueness, and their value proposition.

- Marketing: Cnerzy ensures that SMEs are seen by the right audience, the potential customers who are actively seeking what they offer, ensuring that SMEs stand out in a crowded marketplace.

- Connecting with Confidence: Cnerzy introduces SMEs to buyers, fostering relationships, building a network of trust and reliability. This network is not just about transactions, it is about building a trusted supply chain, a community where businesses can thrive together.

- The 'Quote to Cash' Journey: With Cnerzy, the 'Quote to Cash' process is transformed to a streamlined journey as we guide SMEs through each step, from receiving and responding to quotes to finalizing deals and ensuring timely payments.

- Peace of Mind with Payments: Through milestone-based payment models and escrow services, we help mitigate payment risks, ensure payment security, and foster trust and confidence between buyers and suppliers.

- Facilitating Collaborative Fulfillment: Access a vast network of trusted partners and suppliers for collaborative fulfillment, enabling them to tap into additional resources, expertise, and capabilities to meet customer requirements efficiently. .

- Beyond Business Transactions: Cnerzy believes in growth, not just in terms of business but also in building capabilities. We provide SMEs with insights into the latest trends, and data, empowering them to make informed decisions and stay ahead in the market

Partner with Cnerzy

As a startup, Cnerzy’s mission is to transform the 'Quote to Cash' journey for SMEs, turning it from a potential obstacle into a streamlined pathway to success and ensuring they have the right support, visibility, and connections to not just survive but thrive.

Join Cnerzy and embark on a journey where your business's potential is not just recognized but fully realized. Together, let's redefine what's possible for SMEs, turning challenges into opportunities and aspirations into achievements.

Sources:

- Contribution of SMEs to Developing Economies Report by World Bank

- A report by McKinsey & Company emphasized that COVID-19 accelerated digital transformation

- A report by the World Economic Forum on digital platforms